An Informative Guide for Preppers on Emergency Preparedness and Survival Readiness

Introduction

As preppers and survivalists, understanding the differences between economic recessions and depressions is crucial. Being aware of potential triggers, early warning signals, and historical examples allows us to make prudent forecasts and take proactive measures to prepare our households. In this comprehensive guide, we'll explore key characteristics of recessions versus depressions, examine common causes, analyze impacts on society, and most vitally - outline actionable steps preppers can take to brace for challenging times ahead. Arming ourselves with this knowledge now enables us to shore up our families and communities in advance, successfully ride out any looming storms, and seize opportunities during the recovery. Let's dive in!

Defining Key Terms

To start, we need to understand precisely what constitutes a recession versus a depression:

Recession

A recession refers to a period of reduced economic activity for at least six consecutive months. Key features include:

- Two or more straight quarters of declining Gross Domestic Product (GDP)

- Unemployment rising over 2% above pre-recession rates on average

- Falling retail sales, business investment, industrial production, incomes

- Often triggered by high inflation, spiking interest rates, financial crises

- Usually lasts between 6 months - 2 years

Recent examples include the 2008 housing crisis recession, the 1990s oil price/inflation recession, and 1980s recessions induced by aggressive Federal Reserve interest rate hikes.

Depression

In contrast, a depression is a severe, prolonged economic contraction lasting years rather than months. Marks of a depression:

- GDP dropping 10% or greater from peak levels

- Unemployment exceeding 15-20%

- Widespread bank failures, debt defaults leading to deflation

- Plummeting credit availability, prices, demand and output

- Examples include Great Depression after 1929 crash, Long Depression of late 1800s

In summary, recessions arise when GDP contracts for 2+ quarters, causing elevated unemployment and reduced consumer spending. Depressions are catastrophic multi-year events with double digit GDP declines and unemployment over 20%.

Causes and Early Warning Signs

Spotting potential triggers early allows us to take preventative steps. Be vigilant of:

- Overvalued assets like stocks or real estate forming bubbles

- Excessive leverage and ballooning private/public debt levels

- Geopolitical conflicts disrupting global trade and stability

- Central banks aggressively tightening monetary policy and hiking rates to tame inflation

- Falling consumer and business confidence shown in sentiment surveys

- Inverted yield curve on government bonds

- Spiking unemployment insurance claims

- Cooling metrics for retail, manufacturing, industrial production

We should monitor key economic indicators regularly including:

- GDP, unemployment, housing starts

- Consumer spending, incomes, savings rates

- Manufacturing/services activity, new orders

- Corporate earnings, profit margin trends

- Inflation rate, interest rates, yield curve slope

- Consumer/business confidence surveys

And watch for these market signals of brewing issues:

- Increased stock market volatility and selloffs

- Widening credit spreads on corporate/municipal bonds

- Dropping commodity prices like oil, copper

- Rising demand for safe haven assets like gold, Treasurys

- Strengthening dollar versus foreign currencies

- Slowing real estate transactions and declining prices

Paying attention provides critical early insight so we can get ahead of the curve.

Impacts on Society

When contractions take hold, widespread ripples spread through every area of society:

- Surging unemployment, poverty, home foreclosures

- Plummeting incomes and consumer/business spending

- Tighter access to affordable credit, more loan defaults

- Postponed business investments and expansions

- Strain on government budgets, spiking demand for social services

- Geopolitical conflict risk and breakdown of global trade

Adapting to turmoil, everyday citizens might:

- Adopt highly frugal spending habits, delay major purchases

- Shift to less expensive products, services, brands

- Cut back on eating out, entertainment, vacations, travel

- Take on more DIY home projects instead of hiring help

- Grow backyard gardens, canning, meal prepping, eliminate waste

And investors might shift strategies towards:

- Moving assets out of stocks into cash and bonds

- Prioritizing capital preservation over growth

- Rigorously reviewing budgets and cutting fat

- Being highly selective, waiting patiently for deals in depressed markets

- Diversifying globally to hedge regional downturns

The economic impacts permeate every facet of normal life.

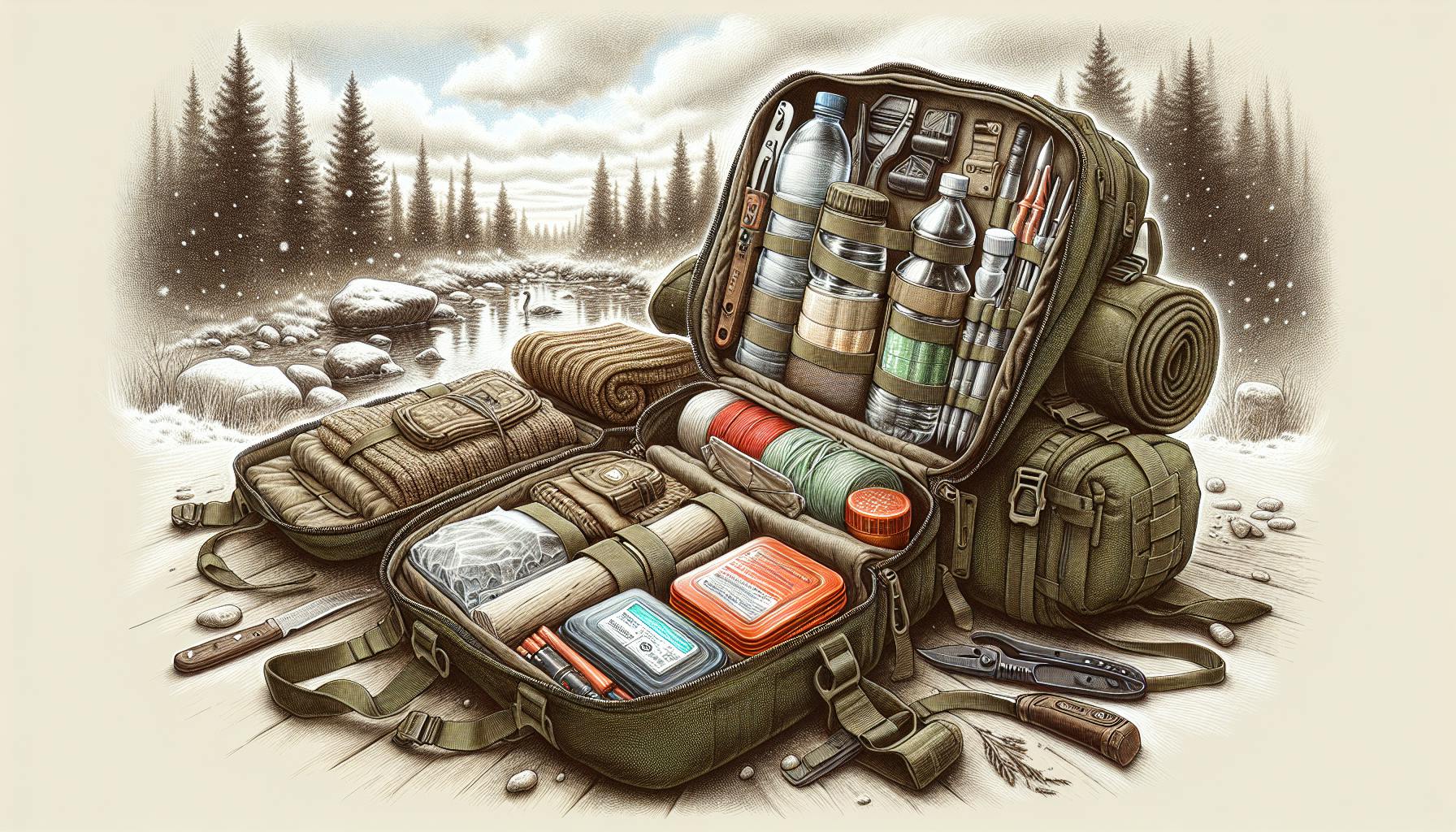

Prepping Considerations

Preppers must take action ahead of time to shelter themselves as much as possible. Key preparations include:

- Stockpiling emergency cash reserves and essentials before prices rise

- Learning productive DIY skills to become more self-reliant

- Strengthening community connections and mutual assistance

- Securing alternate income streams and minimizing debt

- Planning for potential supply chain disruptions, infrastructure and utilities issues

Financial Preparation

To recession-proof our finances:

- Build an emergency fund covering 6-12+ months of expenses

- Eliminate unnecessary recurring costs and subscriptions

- Pay off variable rate debts aggressively

- Lock in fixed rates for bills and essential expenses

Lifestyle Adjustments

We can also make prudent lifestyle adjustments:

- Learn skills to repair, reuse, preserve clothing and food

- Start gardening, raising chickens, hunting/foraging for food

- Barter and trade goods/services within local communities

- Embrace minimalism and make do with less

Relying less on unstable systems makes us better prepared.

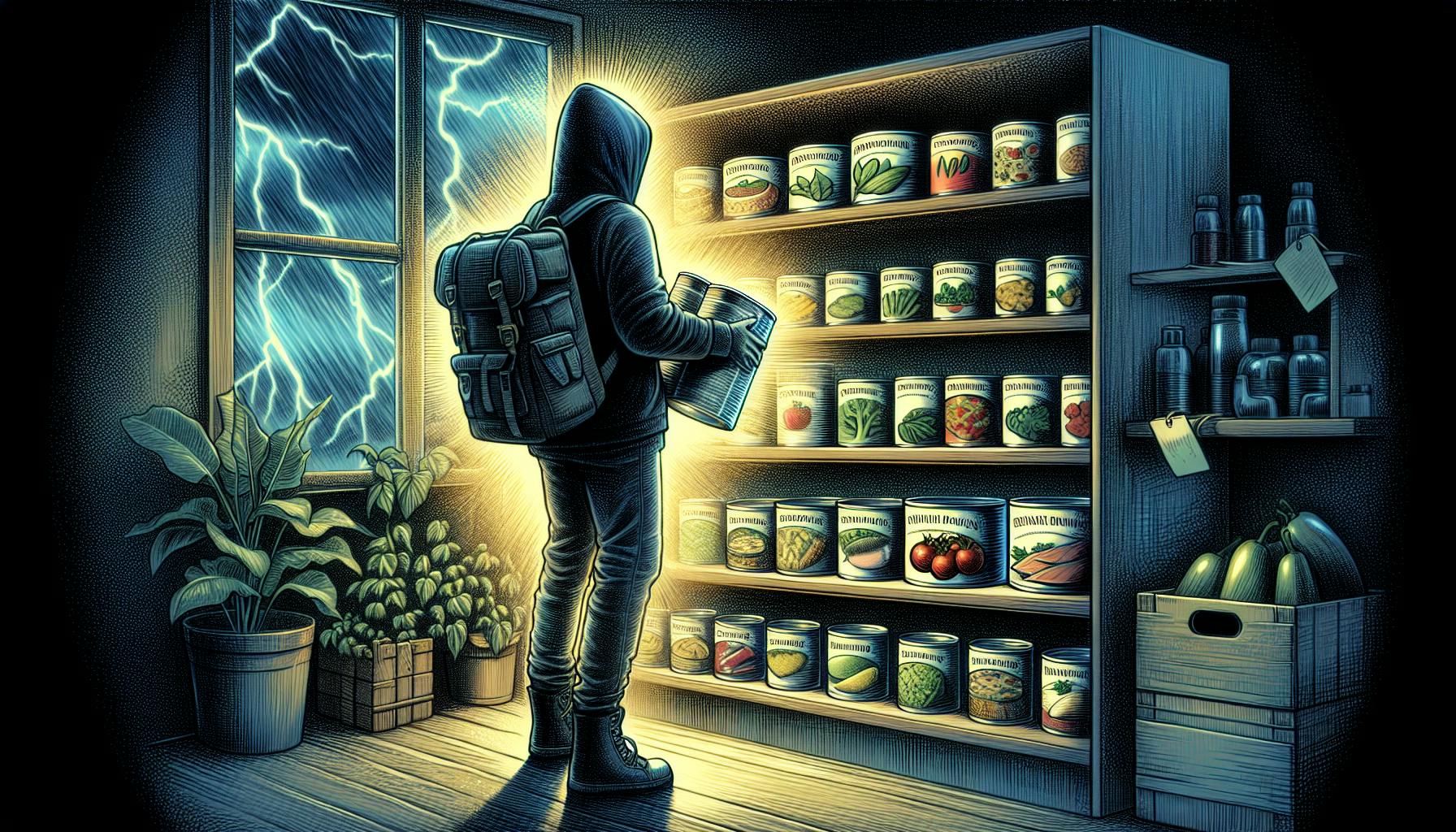

Essential Items to Stockpile

Be sure to stockpile these essential items before economic turmoil escalates:

- Emergency food kits and supplies - canned/dried goods, MREs, freeze-dried meals

- Water storage and filtration - bottled water, gravity filters, water barrels

- Medicine and first aid - OTC meds, bandages, gauze, antibiotics

- Defense and security items - firearms, pepper spray, alarms

Check our recession-proof stockpile guide for more comprehensive supply checklists.

Conclusion

While economic contractions are unavoidable, full-blown depressions are rare. Spotting early signals allows us to take preemptive steps to come through any turmoil in resilient form. Forward-thinking preppers will reinforce their households in advance - stockpiling essentials, honing skills, building community, and minimizing debt. With vigilance and preparation, we can endure any storm and null emerge stronger than before.